- Branch Network Transformation -

GECU

A Branch Network to Drive The Future of Banking

GECU is one of the largest financial institutions in Texas and New Mexico with more than 436,000+ members, 30 branches, and over $4.3 billion in assets.

This community-focused credit union and DBSI have a long-standing relationship that dates back to 2008, and transformations together have ranged from operation centers to branches. That's why when GECU was ready to step its branch network up and into overdrive, they put DBSI to work again.

DBSI got busy helping GECU create and execute a 22+ neighborhood branch expansion strategy. With an objective to increase market penetration and expand into new ones without breaking the bank (pun intended), it was clear to DBSI that GECU needed to both optimize and expand the current network at the same time.

And GECU didn't want to build traditional branches. They had a new vision in mind: to change the way people bank with more tech-first branches that take the transactions away from their staff and free them up to make relationships with their members.

Since 2008, GECU and DBSI have collaborated on more than 20 projects, including new branch constructions, branch enhancements, and drive-up locations.

And these transformations continue to yield big results. GECU's Neighborhood Branch expansion strategy has boosted membership by more than 54.7% and led to a 100% in-branch self-service adoption rate.

Design Elements

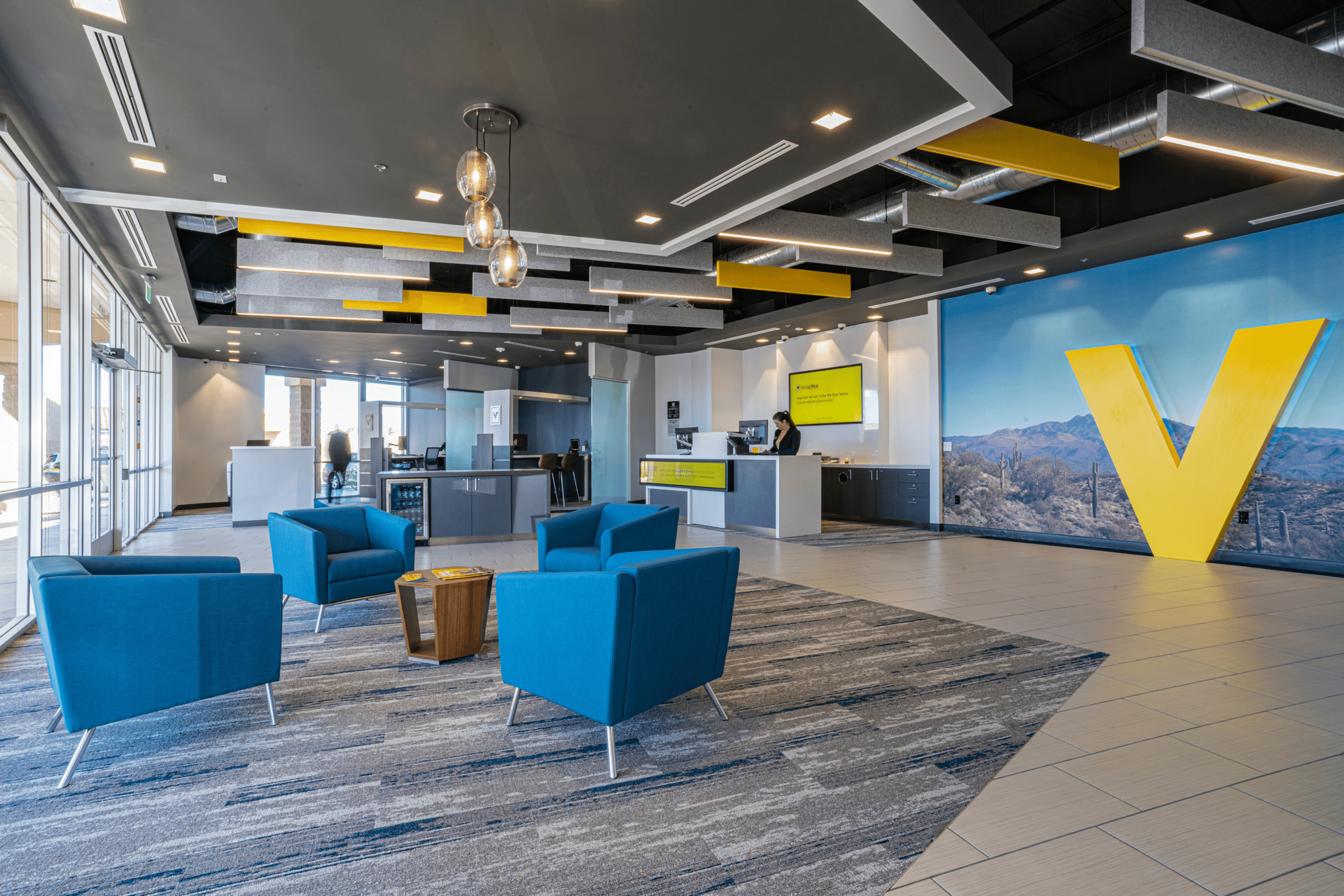

All of the branches, no matter the size of the space, which ranged from a couple hundred square feet to a couple thousand, were designed with the purpose of being a cashless financial institution that offers visitors advisory-level services. To accomplish this all branches have an open floorplan, strategically placed technology, and comfortable meeting and seating areas.

Branded Exteriors

Inviting Lobbies

Discovery Bars

Conversation Stations

Greeter Stations

Branded Exteriors

Inviting Lobbies

Discovery Bars

Conversation Stations

Greeter Stations

Design Elements

All of the branches, no matter the size of the space, which ranged from a couple hundred square feet to a couple thousand, were designed with the purpose of being a cashless financial institution that offers visitors advisory-level services. To accomplish this all branches have an open floorplan, strategically placed technology, and comfortable meeting and seating areas.

WOW Walls & Promotional Displays

Community Boards

Interactive Kiosks

Discovery Tablets & Stretch Displays

DIGITAL SIGNAGE

In a tech-first space where client engagement is a top priority, digital signage was a pivotal part of the GECU branch transformations. Every branch has a variety of signage, ranging from wow walls to tablets to interactive kiosks.

Banking Equipment

As the first credit union in Texas to bring the NCR Interactive Teller Machine (ITM) to life in their branches, GECU relied on DBSI’s expertise to create a design and layout that incorporated this technology into an intuitive flow. This initiative has been so successful, DBSI has now deployed 117 ITMs across GECU's branches using this design.

ITMs

ATMs

Drive-Up Systems

ITMs

ATMs

Drive-Up Systems

Banking Equipment

As the first credit union in Texas to bring the NCR Interactive Teller Machine (ITM) to life in their branches, GECU relied on DBSI’s expertise to create a design and layout that incorporated this technology into an intuitive flow. This initiative has been so successful, DBSI has now deployed 117 ITMs across GECU's branches using this design.

"DBSI helped us realize that Digital Signage was the quickest and most cost-effective way to update our network. It's really level up each of our branch environments without the need for expensive, overhauling renovations to each space.""DBSI has been a vital partner as we adjust and create key strategies to stay competitive and top of mind in our market."

SVP, Operations & Member Experience

GECU

Explore Similar Projects

Trust DBSI With Your Next Project

If you have a transformation project on your to-do list, let's talk about how DBSI can help make it happen.